search engine

Saturday, August 29, 2009

Fundamental Analysis: Study Economics, Trade the markets

Fundamental analysis aims to predict future market action on the basis of economic data and news. While technical analysis focuses strictly on the price, fundamental analysis studies the economic, political, and social dynamics in an economy in order to reach conclusions about an asset, which is a currency pair in Forex of course. As fundamental analysts are aim is to identify the most powerful forces driving the price action, and then to formulate our strategies on that basis. At different times different factors will acquire greater significance in fundamental analysis. For example, in the first half of 2008 the ruble would be expected to appreciate by fundamental analysts as oil became more expensive, and commodity prices were the most important dynamic behind the prices. In August 2008, however, as war between Georgia and Russia broke out, traders would disregard economic factors and sell off the ruble as political factors (in our case, a war) became the dominant mover of the currency prices.

It is important to make a distinction between news trading and fundamental analysis. The markets immediate reaction to news events is mostly unpredictable, since there is not time to evaluate and formulate a proper strategy so soon after a release. News trading is more about technical patterns than fundamental analysis. Fundamental analysis involves the refinement of news data, the isolation of important pieces from the irrelevant ones, and the construction of a big picture which can then be used as a long term road-map for trading. Economic events interact with each other, and individual pieces of data do not mean much for a Forex strategy in isolation.

Fundamental analysis is reputed to be hard, but there's no evidence for this. It does require a bit more thinking on the part of the trader, but given how profitable and satisfying it can be to succeed in trading, that is only a small price to be paid. If you choose to apply this method to your trading, and persevere in your practice, surely the rewards will be more than satisfactory in comparison to even your highest expectations.

By Carl Hayes

FOREX

There are many markets: markets for stocks, futures, options and currencies. These are probably the most accessible markets for everyday traders like you and I. People easily understand the basics of trading shares, so I will occasionally use examples from that market.

I began trading shares first and then I moved on to trading currencies; therefore, most of the examples I will be using in this book are derived from trading currencies.

If you do not know a lot about currency trading, allow me to introduce it to you. It is what I trade and I believe that it is one of the best markets to trade because of its efficiency. The transaction costs to execute a trade are minimal and most brokers provide you with the tools and data you need to make your trading decisions, they usually provide them for free. The market is open 24 hours a day which allows you to design your trading hours around your daily commitments. It is very volatile, which is great for those people who are looking for day-trading opportunities.

The foreign exchange market is the market in which currencies are bought and sold against one another. People may loosely refer to this market under different labels, including foreign exchange market, forex market, fx market or the currency market.

The foreign exchange market is the largest market in the world, with daily trading volumes in excess of $1.5 trillion US dollars. All transactions involving international trade and investment must go through this market because these transactions involve the exchange of currencies.

It is the most perfect market that exists because it has a large number of buyers and sellers all selling the same products. There is a free flow of information and there are little barriers to participate.

The currency exchange market is an over-the-counter (OTC) market which means that there is not one specific location where buyers and sellers can actually meet to exchange currencies. Instead, transactions are conducted by phone, fax, e-mail or through the websites of brokers who specialize in currency trading.

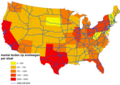

The major dealing centres at the time of writing are: London , with about 30% of the market, New York , with 20%, Tokyo , with 12%, Zurich , Frankfurt, Hong Kong and Singapore , with about 7% each, followed by Paris and Sydney with 3% each. Because of the fact that these centres are all over the world, foreign exchange traders can execute transactions 24 hours a day. The market only closes on the weekends.

THE MAIN 'PLAYERS' IN THE FOREX MARKET

The five broad categories of participants are: consumers, businesses, investors, speculators, commercial banks, investment banks and central banks.

Consumers, including visitors of countries, tourists and immigrants, do need to exchange currencies when they travel so that they can buy local goods and services. These participants do not have the power to set prices. They just buy and sell according to the prevailing exchange rate. They make up a significant proportion of the volume being traded in the market.

Businesses that import and export goods and services need to exchange currencies to receive or make payments for goods they may have bought or services they may have rendered.

Investors and speculators require currencies to buy and sell investment instruments such as shares, bonds, bank deposits or real estate.

Large commercial and investment banks are the 'price makers'. They are the ones who buy and sell currencies at the bid-and-offer exchange rates that they declare through their foreign exchange dealers.

Commercial banks deal with customers on one hand, and with the Interbank or other banks, on the other hand. They profit by utilizing the bid-and-offer spread. The bid price is the exchange rate that the buyer is willing to buy and the offer price is the exchange rate at which the seller is willing to sell. The difference is called the bid-offer spread. They also make profits from speculating about whether the exchange rate will rise or fall.

Central banks participate in the foreign exchange market in their effective duty as banks for their particular government. They trade currencies not for the intention of making profits but rather to facilitate government monetary policies and to help smoothen out the fluctuation of the value of their economy's currency.

by Marquez Comelab

Forex: Benefits of Trading the Forex Market

Some of the benefits of trading the Forex market are:

Superior liquidity.

Liquidity is what really makes the Forex market different from other markets. The Forex market is by far the most liquid financial market in the world with nearly 2 trillion dollars traded everyday. This ensures price stability and better trade execution. Allowing traders to open and close transactions with ease. Also such a tremendous volume makes it hard to manipulate the market in an extended manner.

24hr Market.

This one is also one of the greatest advantages of trading Forex. It is an around the click market, the market opens on Sunday at 3:00 pm EST when New Zealand begins operations, and closes on Friday at 5:00 pm EST when San Francisco terminates operations. There are transactions in practically every time zone, allowing active traders to choose at what time to trade.

Leverage trading.

Trading the Forex Market offers a greater buying power than many other markets. Some Forex brokers offer leverage up to 400:1, allowing traders to have only 0.25% in margin of the total investment. For instance, a trader using 100:1 means that to have a US$100,000 position, only US$1,000 are needed on margin to be able to open that position.

Low Transaction costs.

Almost all brokers offer commission free trading. The only cost traders incur in any transaction is the spread (difference between the buy and sell price of each currency pair). This spread could be as low as 1 pip (the minimum increment in any currency pair) in some pairs.

Low minimum investment.

The Forex market requires less capital to start trading than any other markets. The initial investment could go as low as $300 USD, depending on leverage offered by the broker. This is a great advantage since Forex traders are able to keep their risk investment to the lowest level.

Specialized trading.

The liquidity of the market allows us to focus on just a few instruments (or currency pairs) as our main investments (85% of all trading transactions are made on the seven major currencies). Allowing us to monitor, and at the end get to know each instrument better.

Trading from anywhere.

If you do a lot of traveling, you can trade from anywhere in the world just having an internet connection.

Some of the most important differences between the Forex market and other markets are explained below.

Forex market vs. Equity markets

Liquidity

FX market: Near two trillion dollars of daily volume.

Equity market: Around 200 billion on a daily basis.

Trading hours

FX market: 24hr market, 5.5 days a week.

Equity market: Monday through Friday from 8:30 EST to 5:00 EST.

Profit potential

FX market: In both, rising and falling markets.

Equity market: Most traders/investor profit only from rising markets.

Transaction costs

FX market: Commission free and tight spreads.

Equity market: High Commissions and transaction fees.

Buying power

FX market: Leverage up to 400:1.

Equity market: Leverage from 2:1 to 4:1.

Specialization

FX market: most volume (85%) is made on major currencies (USD, EUR, JPY, GBP, CHF, CAD and AUD.)

Equity market: More than 40,000 stocks to choose from.

Forex market vs. Futures market

Liquidity

FX Market: Near two trillion dollars of daily volume.

Futures market: Around 400 billion dollars on a daily basis.

Transaction costs

FX market: Commission free and tight spreads.

Futures market: High commissions fees.

Margin

FX market: Fixed rate of margin on every position.

Futures market: Different levels of margin on overnight positions than day time positions.

Trade execution

FX market: Instantaneous execution.

Futures market: Inconsistent execution.

All this makes the Forex market very attractive to investors and traders. But I need to make something clear, although the benefits of trading the Forex market are notorious; it is still difficult to make a successful career trading the Forex market. It requires a lot of education, discipline, commitment and patience, as any other market.

by Raul Lopez

The 6 Advantages Forex Trading Has Over Other invesment

1. Lower Margin

Just like futures and stock speculation, a forex trader has the ability to control a large amount of the currency basically by putting up a small amount of margin. However, the margin requirements that are needed for trading futures are usually around 5% of the full value of the holding, or 50% of the total value of the stocks, the margin requirements for forex is about 1%. For example, margin required to trade foreign exchange is $1000 for every $100,000. What this means is that trading forex, a currency trader's money can play with 5-times as much value of product as a futures trader's, or 50 times more than a stock trader's. When you are trading on margin, this can be a very profitable way to create an investment strategy, but it's important that you take the time to understand the risks that are involved as well. You should make sure that you fully understand how your margin account is going to work. You will want to be sure that you read the margin agreement between you and your clearing firm. You will also want to talk to your account representative if you have any questions.

The positions that you have in your account could be partially or completely liquidated on the chance that the available margin in your account falls below a predetermined amount. You may not actually get a margin call before your positions are liquidated. Because of this, you should monitor your margin balance on a regular basis and utilize stop-loss orders on every open position to limit downside risk.

2. No Commission and No Exchange Fees

When you trade in futures, you have to pay exchange and brokerage fees. Trading forex has the advantage of being commission free. This is far better for you. Currency trading is a worldwide inter-bank market that lets buyers to be matched with sellers in an instant.

Even though you do not have to pay a commission charge to a broker to match the buyer up with the seller, the spread is usually larger than it is when you are trading futures. For example, if you were trading a Japanese Yen/US Dollar pair, forex trade would have about a 3 point spread (worth $30). Trading a JY futures trade would most likely have a spread of 1 point (worth $10) but you would also be charged the broker's commission on top of that. This price could be as low as $10 in-and-out for self-directed online trading, or as high as $50 for full-service trading. It is however, all inclusive pricing though. You are going to have to compare both online forex and your specific futures commission charge to see which commission is the greater one.

3. Limited Risk and Guaranteed Stops

When you are trading futures, your risk can be unlimited. For example, if you thought that the prices for Live Cattle were going to continue their upward trend in December 2003, just before the discovery of Mad Cow Disease found in US cattle. The price for it after that fell dramatically, which moved the limit down several days in a row. You would not have been able to leave your position and this could have wiped out the entire equity in your account as a result. As the price just kept on falling, you would have been obligated to find even more money to make up the deficit in your account.

4. Rollover of Positions

When futures contracts expire, you have to plan ahead if you are going to rollover your trades. Forex positions expire every two days and you need to rollover each trade just so that you can stay in your position.

5. 24-Hour Marketplace

With futures, you are generally limited to trading only during the few hours that each market is open in any one day. If a major news story breaks out when the markets are closed, you will not have a way of getting out of it until the market reopens, which could be many hours away. Forex, on the other hand, is a 24/5 market. The day begins in New York, and follows the sun around the globe through Europe, Asia, Australia and back to the US again. You can trade any time you like Monday-Friday.

6. Free market place

Foreign exchange is perhaps the largest market in the world with an average daily volume of US$1.4 trillion. That is 46 times as large as all the futures markets put together! With the huge number of people trading forex around the globe, it is very hard for even governments to control the price of their own currency.

by David Morrison

first stock exchange

Some stories suggest that the origins of the term "bourse" come from the Latin bursa meaning a bag because, in 13th century Bruges, the sign of a purse (or perhaps three purses), hung on the front of the house where merchants met.

House Ter Beurze in Bruges, Belgium.

However, it is more likely that in the late 13th century commodity traders in Bruges gathered inside the house of a man called Van der Burse, and in 1309 they institutionalized this until now informal meeting and became the "Bruges Bourse". The idea spread quickly around Flanders and neighbouring counties and "Bourses" soon opened in Ghent and Amsterdam.

In the middle of the 13th century, Venetian bankers began to trade in government securities. In 1351, the Venetian Government outlawed spreading rumors intended to lower the price of government funds. There were people in Pisa, Verona, Genoa and Florence who also began trading in government securities during the 14th century. This was only possible because these were independent city states ruled by a council of influential citizens, not by a duke.

The Dutch later started joint stock companies, which let shareholders invest in business ventures and get a share of their profits—or losses. In 1602, the Dutch East India Company issued the first shares on the Amsterdam Stock Exchange. It was the first company to issue stocks and bonds. In 1688, the trading of stocks began on a stock exchange in London.

On May 17, 1792, twenty-four supply brokers signed the Buttonwood Agreement outside 68 Wall Street in New York underneath a buttonwood tree. On March 8, 1817, properties got renamed to New York Stock & Exchange Board. In the 19th century, exchanges (generally famous as futures exchanges) got substantiated to trade futures contracts and then choices contracts.

There are now a large number of stock exchanges in the world.

Currency Exchange Rates

What is Foreign Currency Exchange Rate? The existing exchange rate of a foreign currency is one of the most desired financial information by many - name it exporters, importers, investors, tourists or even ordinary. Even the ordinary citizens outside the United States hold on to their precious dollars hoping for an increase in the foreign currency exchange rate later on CURRENCY EXCHANGE RATE information Foreign currency exchange rate refers to the value of a certain currency based or compared to the rate of another country’s currency. A foreign currency exchange is said to be increasing its value if it is gaining strength against the.

Hot Stocks to Invest in 2009

Optimism from Fed chief Bernanke and jump in existing home sales propel Wall Street to fresh 2009 highs.

World markets: In overseas trading, European markets gained. Asian shares ended mixed, with the Chinese market higher and the Japanese market lower. Oil: U.S. light crude oil for October delivery settled up 98 cents to $73.89 a barrel on the New York Mercantile Exchange, a 10-month high.Bonds: Treasury prices tumbled, raising the yield on the benchmark 10-year note to 3.57% from 3.42% Thursday. Treasury prices and yields move in opposite directions.Other markets: COMEX gold for December delivery rose $13.50 to $955.20 an ounce.In currency trading, the dollar fell versus the euro and gained against the Japanese yen.

Currency Exchange Rates

What is Foreign Currency Exchange Rate? The existing exchange rate of a foreign currency is one of the most desired financial information by many - name it exporters, importers, investors, tourists or even ordinary. Even the ordinary citizens outside the United States hold on to their precious dollars hoping for an increase in the foreign currency exchange rate later on CURRENCY EXCHANGE RATE information Foreign currency exchange rate refers to the value of a certain currency based or compared to the rate of another country’s currency. A foreign currency exchange is said to be increasing its value if it is gaining strength against the.

Tips to MAKE Money Fast in Forex

We are going to assume that you know how to trade, and has quite an experience in trading.

Fast money is in Forex, it is a lifestyle. here is it how its done.

If you cannot manage and calculate your risk, then don't ever think about trading in Forex. Many traders back away from forex because of this ( why do you even traded in the first place?).

But taking manageable risks has its rewards.It's just simple, you know what your losing if ever it doesn't work out, yet what you gain is unpredictable but sure is high!

That is what I call excitement, my friend.To a well-educated Forex trader, this is something you shouldn't be afraid of, might as well embrace it.

Most traders think that if they don't trade, another door has closed, or miss some move. The tendency, they trade frequently. Most of the trades that come big come a few times in a year. Focus on the trades that make the really big gains. Be alert, and informed.

Most Investors accept the fact that diversification can make money fast - in reality it does exactly the opposite.

This article has been concentrating on the Big gains, because this is your money, so every penny should be controlled, this is where money management kicks in.Control your risks, but increase your chances of success:-

Give yourself staying power by buying options at or in the money, this prevents you from getting stopped out. Many traders lose not by the market direction, but because they were stopped out by a in stable move, and options will give you staying power.- Keep your stop in its original position - until the move is well in profit, before moving it up.- Trading fast and selectively - have the courage to trade when you feel it is good. and enjoy the cash.

The way to make money fast in forex, is to understand the power of compound growth. For example, if you target 50% a year in your trading, you can grow an initial $20,000 account, to over a million dollars, in under 10 years.Break the norm, and gain more. Follow some of these tips and make your way into the big gains!

ECB President Trichet: More Work To Do To Stem Crisis

By Maya Jackson Randall Of DOW JONES NEWSWIRES

JACKSON HOLE, Wyo. -(Dow Jones)- Policy makers around the world must keep up efforts to stem the global crisis - despite signs that the global recession is easing, European Central Bank President Jean-Claude Trichet said Saturday.

In a broad speech to international finance officials, Trichet said finance officials must not get complacent. They need to do all they can to prevent another crisis and sustain recovery, he said.

"This is the very demanding, immediate task of the international community," said Trichet. "And now that we see some signs confirming that the real economy is starting to get out of the period of 'free fall' - which does not mean at all that we do not have a very bumpy road ahead of us - the largest mistake we could make would be to forget the importance and the urgency of this task."

Trichet spoke on a panel during an annual economics conference that has once again attracted central bankers and academics from around the world to Jackson Hole, Wyo.

Trichet also touted monetary policy in Europe as being steady-handed in the face of financial shocks.

"The ECB has acquired a reputation for moving interest rates in a steady and persistent fashion over time," he said. "This is a conscious choice."

Additionally, he weighed in on the issue of whether central banks should respond to asset price bubbles. Trichet argued that there's value in policies that identify financial imbalances and assess the risk of any misaligned pricing of risk. Waiting for an asset bubble to burst and then easing monetary policy creates a moral hazard issue, said Trichet.

Meanwhile, Trichet argued that the current crisis would be worse had central banks not collaborated on efforts to ease the turmoil.

"Without such trustful cooperation, global events could have been much more dramatic," he said.

- Maya Jackson Randall maya.jackson-randall@dowjones.com. 202-862-255

Click here to go to Dow Jones News-plus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=Sys6UH%2Fz82Zcam2S06IWAw%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

HYSTA Announces 2009 Annual Conference - 'Survive and Thrive amidst a Global Economic Crisis: New Opportunities across China and US'

-- Steve Ballmer, CEO of Microsoft

-- Fang Fang, Managing Director and CEO JP Morgan China

-- Steve Westly, Former Controller of CA, Managing Partner of The Westly

Group

-- YiBing Wu, Managing Director, Legend Holding

-- Jeff Xiong, Co-CTO, Tencent

-- Stephanie Tilenius, Senior VP and General Manager, eBay North America

and Global Platform

-- Clarence Kwan, National Managing Partner, Deloitte Chinese Services

Group

-- ShuHua Zhou, Partner, Northern Light

-- David Chen, President, VanceInfo

-- Walter Fang, President, Neusoft America

-- Marc Porat, Chairman/Founder, Calstar, Serious Materials

-- Zheng Xu, CEO, Sierra Power

Advantages of the Forex Market

Investing in Forex by Joe Clinton

A few additional points, which create such powerful leverage for investors within the forex market are: The amount of capital required to begin investing in the market is only three hundred dollars. For the most part, any other investment market is going to demand thousands of dollars of the investor in the beginning. Also, the market offers opportunities to profit regardless what the direction of the market may be; In most commonly known markets investors sit and wait for the market to begin an up trend before entering a trade. Even then, investors, as a rule must sit and wait some more to be able to exit the trade with a nice profit. Given that the forex market produces several up, down, and sideways trends in a single day, it can easily be seen that forex stands head and shoulders above other markets. Additionally there are trading strategies, which are taught that provide for compounded profits; these are profits on top of profits. In addition, free demo accounts are available within the industry of forex trading, which facilitate the sharpening of skills without the risk losing any capital. And the advantage regarding the time factor in trading foreign currency is a very attractive point for any investor. Compared to one of the most sought after avenues of investing, which often requires forty or more hours each week, namely in the real-estate market, the forex market requires a much smaller demand on the investor's time. Forex trading requires approximately ten to fifteen hours each week to earn a full time income. It's easy to see that the advantages and great leverage that exist in the forex market, make it among the most lucrative, time liberating, and easy to enter by far.

I hope this information gives you a clear understanding of how you can turn your investing into a true method of making your money work harder for you.

Saturday, August 22, 2009

Importance of stock market

The stock market is one of the most important sources for companies to raise money. This allows businesses to be publicly traded, or raise additional capital for expansion by selling shares of ownership of the company in a public market. The liquidity that an exchange provides affords investors the ability to quickly and easily sell securities. This is an attractive feature of investing in stocks, compared to other less liquid investments such as real estate.

History has shown that the price of shares and other assets is an important part of the dynamics of economic activity, and can influence or be an indicator of social mood. An economy where the stock market is on the rise is considered to be an up and coming economy. In fact, the stock market is often considered the primary indicator of a country's economic strength and development. Rising share prices, for instance, tend to be associated with increased business investment and vice versa. Share prices also affect the wealth of households and their consumption. Therefore, central banks tend to keep an eye on the control and behavior of the stock market and, in general, on the smooth operation of financial system functions. Financial stability is the raison d'être of central banks.

Exchanges also act as the clearinghouse for each transaction, meaning that they collect and deliver the shares, and guarantee payment to the seller of a security. This eliminates the risk to an individual buyer or seller that the counterparty could default on the transaction.

The smooth functioning of all these activities facilitates economic growth in that lower costs and enterprise risks promote the production of goods and services as well as employment. In this way the financial system contributes to increased prosperity.

Relation of the stock market to the modern financial system

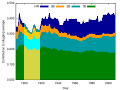

The financial system in most western countries has undergone a remarkable transformation. One feature of this development is disintermediation. A portion of the funds involved in saving and financing flows directly to the financial markets instead of being routed via the traditional bank lending and deposit operations. The general public's heightened interest in investing in the stock market, either directly or through mutual funds, has been an important component of this process. Statistics show that in recent decades shares have made up an increasingly large proportion of households' financial assets in many countries. In the 1970s, in Sweden, deposit accounts and other very liquid assets with little risk made up almost 60 percent of households' financial wealth, compared to less than 20 percent in the 2000s. The major part of this adjustment in financial portfolios has gone directly to shares but a good deal now takes the form of various kinds of institutional investment for groups of individuals, e.g., pension funds, mutual funds, hedge funds, insurance investment of premiums, etc. The trend towards forms of saving with a higher risk has been accentuated by new rules for most funds and insurance, permitting a higher proportion of shares to bonds. Similar tendencies are to be found in other industrialized countries. In all developed economic systems, such as the European Union, the United States, Japan and other developed nations, the trend has been the same: saving has moved away from traditional (government insured) bank deposits to more risky securities of one sort or another.

The stock market, individual investors, and financial risk

Riskier long-term saving requires that an individual possess the ability to manage the associated increased risks. Stock prices fluctuate widely, in marked contrast to the stability of (government insured) bank deposits or bonds. This is something that could affect not only the individual investor or household, but also the economy on a large scale. The following deals with some of the risks of the financial sector in general and the stock market in particular. This is certainly more important now that so many newcomers have entered the stock market, or have acquired other 'risky' investments (such as 'investment' property, i.e., real estate and collectables).

With each passing year, the noise level in the stock market rises. Television commentators, financial writers, analysts, and market strategists are all overtaking each other to get investors' attention. At the same time, individual investors, immersed in chat rooms and message boards, are exchanging questionable and often misleading tips. Yet, despite all this available information, investors find it increasingly difficult to profit. Stock prices skyrocket with little reason, then plummet just as quickly, and people who have turned to investing for their children's education and their own retirement become frightened. Sometimes there appears to be no rhyme or reason to the market, only folly.

This is a quote from the preface to a published biography about the long-term value-oriented stock investor Warren Buffett.[4] Buffett began his career with $100, and $105,000 from seven limited partners consisting of Buffett's family and friends. Over the years he has built himself a multi-billion-dollar fortune. The quote illustrates some of what has been happening in the stock market during the end of the 20th century and the beginning of the 21st century.

stock market

The size of the world stock market was estimated at about $36.6 trillion US at the beginning of October 2008.The total world derivatives market has been estimated at about $791 trillion face or nominal value, 11 times the size of the entire world economy. The value of the derivatives market, because it is stated in terms of notional values, cannot be directly compared to a stock or a fixed income security, which traditionally refers to an actual value. Moreover, the vast majority of derivatives 'cancel' each other out (i.e., a derivative 'bet' on an event occurring is offset by a comparable derivative 'bet' on the event not occurring.). Many such relatively illiquid securities are valued as marked to model, rather than an actual market price.

The stocks are listed and traded on stock exchanges which are entities of a corporation or mutual organization specialized in the business of bringing buyers and sellers of the organizations to a listing of stocks and securities together. The stock market in the United States includes the trading of all securities listed on the NYSE Euronext, the NASDAQ, the Amex, as well as on the many regional exchanges, e.g. OTCBB and Pink Sheets. European examples of stock exchanges include the London Stock Exchange, the Deutsche Börse.

The International Student Loan Center

| International Students | US Students |

| This private loan program is available for international students who are planning to study in the USA. | Federal and private loan programs are available for US Students who are studying abroad or fully enrolled in a non-US School. |

An Envisage International Corporation website, Copyright © 1998-2009

Your website for international student loans and study abroad loans since 1998!

Doral Bank NY FSB, an Equal Opportunity Lender is the lender for the International Student Loan

Canadian Student Loan Program

For Canadian students studying or planning to study in the USA, we offer the Canadian Student Loan. Students applying for the Canadian Student Loan will require a US citizen or permanent resident co-signer.

Formerly, we offered the CanHelp loan, which was available with a Canadian co-signer; however, as of April 18, 2008 the CanHelp loan has been discontinued and is no longer available. Instead of the CanHelp, Canadian students can now apply for a Canadian Student Loan for study in the USA.

Canadian students can apply for the loan program by phone, and can borrow up to the cost of attendence for their school. Canadian students are required to have a US Citizen or permanent resident as a co-signer to apply for this loan.

These loans also offer:

- Funds disbursed directly to you

- Loans are accepted at thousands of approved schools

- Competitive interest rates

- No application fees

International Student Loans

For more information about the particular student loan products, please see below:

Student Loans for International Students

The International Student Loan Program is available to international students from around the world, who are looking to study in the USA. You have to be attending one of the approved schools, and you must also have a US Citizen or permanent resident to cosign the loan with you. The International Student Loan offers funding that is disbursed directly to you, with competitive interest rates and no application fees!

Student Loans for Study Abroad

The Study Abroad Loan provides funding for US Citizens who are looking to participate in a study abroad programs outside of the USA. Students need to be attending an approved school in the USA and have no need to complete a FAFSA form. Funds acan be available in a little as 5 days.

Student Loan for Canadian Citizens

For Canadian students studying or planning to study in the USA, we offer the Canadian Student Loan. Students applying for the Canadian Student Loan will require a US citizen or permanent resident co-signer. Formerly, we offered the CanHelp loan, which was available with a Canadian co-signer; however, as of April 18, 2008 the CanHelp loan has been discontinued and is no longer available. Instead of the CanHelp, Canadian students can now apply for a Canadian Student Loan for study in the USA.

Student Loans for US Citizens Foreign Enrolled

The Foreign Enrolled Loan program provides US Citizens with funding for their education when they plan to enroll directly in a degree program abroad. This is a private, alternative loan that offers high loan limits to cover the cost of school abroad, with borrowing limits up to $50,000 per year for undergraduate programs and up to $70,000 per year for medical, dental, business or law school.

Study Abroad Loans

Loans are available for US students studying abroad, and are becoming incredibly important in meeting the demand for international education. US students studying outside the US fall into two categories for student loans, Study Abroad Loans for short-term foreign study and Foreign Enrolled Loans for direct enrollment overseas.

Study Abroad Loans

Study Abroad Loans are for those enrolled in a US school and studying abroad on a short-term program. You must be receiving credit at your home school for your study abroad, and your home school also must be approved. If so, your program can be located anywhere in the world. Of course, although you can apply on your own, you are much more likely to be approved and to get better rates with a qualified co-signer. We partner with two programs for Study Abroad Loans, each of which offer very similar and competitive products with different strengths:

> Study Abroad Loan from InternationalStudentLoan.com - offers competitive rates, online application and fast funding directly to the student. There are thousands of approved schools, and annual loan limits are the lower of $30,000 per year ($40,000 at certain select schools) or the maximum amount calculated for your school.

> Study Abroad Loan from StudyAbroadLoans.com - offers competitive rates, online application and fast funding directly to the student. There are a large number of approved schools, and student can obtain up to $50,000 per year for their study abroad program.

Which program is better for studying abroad?

In most regards the loans are very comparable from the two providers. However, StudyAbroadLoans.com will lend up to $50,000 per year for study abroad, so it's a good choice if you need a large loan. The StudyAbroadLoans.com program does not have as many approved schools, so if you do not see your school listed on that site, check out the InternationalStudentLoan.com study abroad loan program described above.

Foreign Enrolled Loans

Foreign Enrolled Loans are for US students directly enrolled and working towards a degree or certificate at a non-US school. There are over 400 approved schools around the world. With the Foreign Enrolled Loan, you can borrow up to $50,000 per year for undergraduate programs, and up to $70,000 per year for medical, dental, law or business school. A qualified US co-signer is strongly encouraged, though you can apply without one if you have built up good credit history. The high loan limits are helpful, especially if you choose to study in the UK, Western Europe or other areas with a high cost of living. You can find more information about loans for foreign enrolled students at InternationalStudentLoan.com.

Stafford and Plus Loans

As a US citizen or permanent resident, you have access to an excellent government-backed funding resource in Stafford and Plus loans. Before maxing out your private loans, make sure you start early, complete your FAFSA and apply for as much as possible through a Stafford loan; then get the remainder through a private loan described above.

Thursday, August 20, 2009

Difference Between Forex and Stock

2. Forex traders could obtain a much larger transaction compared to the stock market, through the Forex trading, Forex traders could obtain 100 times larger transaction compared to the stock market. According to the present US situation, if a Forex trader invests $1,000 in the stock market, the trader may obtain $2,000 of stock domination property with a proportion of 2:1, but through Forex trading, a Forex trader can do transaction with a proportion up to 100:1.

Forex trader may make profit from the ordinary news, like the interest rate change, Forex market is closely related to various countries' politic, economy and culture, Forex traders could also obtain profit from other kinds of news, for example interest rate level change, will influence the interest of the Forex deposit.

3. Forex traders could do 24 hours trading. The stock market can only be traded during daytime at a specific time, generally from 9:30a.m. to 4:00p.m.. If you too have your own full time job, then you will face the dilemma - either to give up your full time job or forgo the trading opportunity. But Forex market can be traded 5 days a week and 24 hours a day, Forex traders can trade during their free time which is normally at night after working hour.

4. If a trader analyze based on technical analysis, Forex trading would be much more suitable for such traders because the Forex market has a very large trading volume. Currently the Forex market has daily trading volume of 190 billion Dollar, such giant market will completely digest a fore trader's transaction cash, under such situation the accuracy of the technical analysis would be much higher then any financial market, the chances of using technical analysis to make profit would be much more higher.

Standard Forex Account

State-of-the-art trading software. The GCI trading software provides real-time prices in currencies, global equity indices, gold, silver, and crude oil. Live charts, and real-time P&L and account equity tracking are fully integrated into the free software. Windows-based and Java-based versions are available. Download a free demo...

Zero commissions. Client trading performance is enhanced by eliminating all commissions and transaction fees.

USD or Euro Denominated Trading Accounts. GCI clients can now choose to maintain their account balance and P&L in either US Dollars or Euros. Select the Base Currency you want for your account on the account application.

Trade on 2 pip spreads. Clients can trade on tight spreads in major currencies and crosses, 24 hours a day. Unlike many competitors, GCI's spreads are consistent in all market conditions and will never widen during volatile times or news releases.

Hedging Capability. Clients can open positions in the same currency in opposite directions, without the positions offsetting and without using additional margin.

Product Offerings. You can also trade Gold, Crude Oil, S&P 500, DAX 30, Nikkei 225, and Dow Jones on the same trading platform - with the same low margin requirements and zero commissions.

Risk is limited to deposited funds. GCI's sophisticated margin and dealing procedures mean that clients can never lose more than their funds on deposit. All customer funds are insured and maintained in separate accounts.

Tools for successful trading. GCI clients benefit from a wide array of resources to improve their trading results, including market analysis and research, real-time charts, and free Forex trading signals.

Forex Trading Software Preview

ICTS Trading Software

Trade currencies on 2 pip spreads from the Dealing Rates Table or directly from real-time charts. You can set alerts, place conditional orders, and take advantage of our AFX news feed, live quotes, comprehensive real-time position and account tracking, and mobile trading access.

Prices from the "Dealing Rates" windows are constantly updating and can be clicked on at any time to place a trade. This full-featured trading platform also provides real-time account balance, P&L, and margin information, and real-time charts and news. Recent enhancements include the ability to "hedge" (enter opposite positions in the same currency without offsetting or using additional margin).

Click here for a Free ICTS Forex Trading Demo Account...

MetaTrader Trading Software

GCI now offers Forex and CFD trading on the popular MetaTrader 4 trading platform. Trading directly from charts, fractional lot capabilities, the ability to program trading signals, and unlimited charts and technical indicators are among the many benefits. MetaTrader is ideal for novice traders and professionals alike. All major currency orders are filled directly in the interbank market, with no dealer intervention or delays.

Test MetaTrader software for free: download the installation file (gci4setup.exe, 3.5Mb) to your PC, launch it and install the program, checking for instructions appearing on your monitor.

MetaTrader Trading Software: Download Here

What is Forex Trading????????

Forex trading

The investor's goal in Forex trading is to profit from foreign currency movements. Forex trading or currency trading is always done in currency pairs. For example, the exchange rate of EUR/USD on Aug 26th, 2003 was 1.0857. This number is also referred to as a "Forex rate" or just "rate" for short. If the investor had bought 1000 euros on that date, he would have paid 1085.70 U.S. dollars. One year later, the Forex rate was 1.2083, which means that the value of the euro (the numerator of the EUR/USD ratio) increased in relation to the U.S. dollar. The investor could now sell the 1000 euros in order to receive 1208.30 dollars. Therefore, the investor would have USD 122.60 more than what he had started one year earlier. However, to know if the investor made a good investment, one needs to compare this investment option to alternative investments. At the very minimum, the return on investment (ROI) should be compared to the return on a "risk-free" investment. One example of a risk-free investment is long-term U.S. government bonds since there is practically no chance for a default, i.e. the U.S. government going bankrupt or being unable or unwilling to pay its debt obligation.When trading currencies, trade only when you expect the currency you are buying to increase in value relative to the currency you are selling. If the currency you are buying does increase in value, you must sell back the other currency in order to lock in a profit. An open trade (also called an open position) is a trade in which a trader has bought or sold a particular currency pair and has not yet sold or bought back the equivalent amount to close the position.

However, it is estimated that anywhere from 70%-90% of the FX market is speculative. In other words, the person or institution that bought or sold the currency has no plan to actually take delivery of the currency in the end; rather, they were solely speculating on the movement of that particular currency.

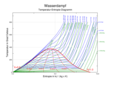

Charts

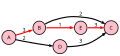

A chart is a visual representation of data, in which the data are represented by symbols such as bars in abar chart or lines in a line chart.[1] A chart can represent tabular numeric data, functions or some kinds of qualitative structures.

Overview

The term "chart" as a visual representation of data has multiple meanings.

- A data chart is a type of diagram or graph, that organizes and represents a set of numerical or qualitative data.

- Maps that are ardorned with extra information for some specific purpose are often known as charts, such as a nautical chart or aeronautical chart.

- Other domain specific constructs are sometimes called charts, such as the chord chart in music notation or a record chart for album popularity.

Charts are often used to ease understanding of large quantities of data and the relationships between parts of the data. Charts can usually be read more quickly than the raw data that they are produced from. They are used in a wide variety of fields, and can be created by hand (often ongraph paper) or by computer using a charting application. Certain types of charts are more useful for presenting a given data set than others. For example, data that presents percentages in different groups (such as "satisfied, not satisfied, unsure") are often displayed in a pie chart, but may be more easily understood when presented in a horizontal bar chart[citation needed]. On the other hand, data that represents numbers that change over a period of time (such as "annual revenue from 1990 to 2000") might be best shown as a line chart.

Types of charts

[edit]Common charts

Four of the most common charts are:

Histogram |  bar chart |  Pie chart |  Line chart |

This gallery shows:

- A histogram typically shows the quantity of points that fall within various numeric ranges (or bins).

- A bar chart uses bars to show frequencies or values for different categories.

- A pie chart shows percentage values as a slice of a pie.

- A line chart is a two-dimensional scatterplot of ordered observations where the observations are connected following their order.

Other common charts are:

Timeline chart |  Organizational chart |  Tree chart |  Flow chart |

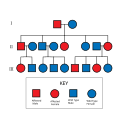

Area chart |  Cartogram |  Pedigree chart |  Funnel chart |

[edit]Less-common charts

Examples of less common charts are:

Bubble chart |  Polar area diagram |  Waterfall chart |  Radar chart |

This gallery shows:

- A bubble chart is a two-dimensional scatterplot where a third variable is represented by the size of the points.

- A Polar area diagram developed by Florence Nightingale is an enhanced form of pie chart.

- A radar chart or "spider chart" is a two-dimensional chart of three or more quantitative variables represented on axes starting from the same point.

- A waterfall chart also known as a "Walk" chart, is a special type of floating-column chart.

[edit]Field-Specific Charts

Some types of charts have specific uses in a certain field

Open-high-low-close chart |  Candlestick chart | Kagi chart | Sparkline |

This gallery shows:

- Stock market prices are often depicted with a open-high-low-close chart with a traditional bar chart of volume at the bottom.

- Candlestick charts are another type of bar chart used to describe price movements of an equity over time.[2]

- A Kagi chart is a time-independent stock tracking chart that attempts to minimise noise.

- Alternatively, where less detail is required and chart size is paramount, a Sparkline may be used.

Other examples:

- Interest rates, temperatures, etc., at the close of the period are plotted with a line chart.

- Project planners use a Gantt chart to show the timing of tasks as they occur over time.

[edit]Well-known named charts

Some of the more well known named charts are:

Gantt chart |  Nolan chart |  PERT chart |  Smith chart |

Some specific charts have become well known by effectively explaining a phenomenon or idea.

- An Allele chart is a chart originating from the study of genetics to show the interaction of two data points in a grid.

- A Gantt chart helps in scheduling complex projects.

- The Nolan chart is a libertarian political chart.

- A PERT chart is often used in project management.

- The Pournelle chart is a political chart to categorize state and rational ideologies.

- The Smith chart serves in radio electronics.

[edit]Other charts

There are dozens of other types of charts. Here are some of them:

Control chart |  Natal chart |  Nomogram |  Pareto chart |

Run chart |  Structure chart |  Vowel chart |

[edit]Common plots

- Main article: Plot (graphics)

Box plot |  Dot plot (statistics) |  Probability plot |